Calculate Your Consulting Fees - How Do You Compare?

Jul 01, 2023

Calculating consulting fees can seem difficult if you don't know where to start. But there is a science to it you can follow.

You are an expert in your field. You feel confident helping clients solve their problems. Then, that new client hits you with the dreaded question, “What are your fees?”

All the fears whirl in your mind. You've been considering raising your rates but charge too much, and you lose the work! Too little, and you devalue yourself and go broke!

You are an expert. You have experience. But you don’t know how to set or calculate fees. Should you ask a friend? Go to Redditt or Quora? Take a guess?

Also, you can use at least nine consulting business models to structure your fees. Which one should you use if you are new or working your way up?

The blog 9 Consulting Fee Structures to Boost Your Income describes nine different ways of setting consulting fees. The nine ways are,

- Pro Bono

- Hourly, Daily, and Weekly Rates

- Monthly Retainers

- Project Based Rates/Fees

- Agile Agency (Agency modified for independents)

- ROI-Based Fee

- Value-Based Fee

- Packaged or Productized Fees

- Multiple Streams of Income

Each of those fee structures is different in how they set fees. Although fees vary dramatically, they are usually based on,

- The value increase for the client

- The brand and image of the consultant

- The niche and uniqueness of the solution

- The cost and availability of consulting and non-consulting solutions

Before looking at how to calculate different fees you may want to read the blog, 9 Independent Consulting Business Models to Boost Your Income and Lifestyle. This blog describes nine fee structures and their advantages, disadvantages, and how to move to a higher income fee structure.

Calculating and Setting Consulting Fees

This blog describes how to calculate the fee or value exchange for pro bono and hourly/daily consulting rates. Additional blogs describe calculating and setting,

- Project-based Fees

- Monthly Retainers

- ROI-based Fees

The Consulting Mastery Series(tm) courses go into greater depth on consulting rates and fees, including project-based fees and ROI-based fees and include proven, in-depth ROI-value calculators that have been used to sell million-dollar contracts.

Pro Bono Consulting

Pro bono publico is Latin for professional work done without payment. While a pro bono engagement may not have money being transferred there is value transfer for both consultant and client.

I have done many pro bono consulting engagements that gave value to the client and to me. There are many forms of value besides monetary. Pro bono consulting can “pay” you with,

- Contribution to the common (public) good

- Testimonials

- Increased expertise

- Time and task data useful on new consulting projects

- Increased brand image for your consulting

- Connection with a network of executives or donors

As a consultant, you need to be even more careful selecting pro bono clients than paying clients. Working with the wrong pro bono client or on the wrong project can harm growing your consulting.

- Do not do pro bono consulting where the client has little or no commitment. The client and their employees must be committed to listening and implementing major parts of your recommendations. Too often, when something is “free” people or organizations will want it, but then will not put in the work or commitment to implement it. The solution is to charge a minimal fee, perhaps offering a 50% to 75% discount.

- Will the pro bono work distract you from your bigger purpose? While it might be momentarily beneficial to the client you may be able contribute more with a different opportunity.

Hourly, Daily, and Weekly Consulting Rates

New consultants often start out by charging by the hour or day. Hourly and daily consulting rates are easier to calculate and seem easier to negotiate.

You should move past hourly or daily rates as quickly as possible. Most experienced consultants use project-based or ROI/Value-based fees.

Here are a few of the problems with hourly/daily consulting rates.

- If you are working hourly, it is easy to be viewed as an hourly freelancer and compared to freelancers on websites such as Upwork or Fiverr. This makes it difficult to change your personal brand so you are viewed as a high-value consultant.

- A micro-managing client may pick apart your time sheets asking why a task took so much time.

- If you identify and recommend additional projects or tasks, the client may think you are trying to increase your billing rather than to give them greater value.

- You may need to produce proof to your government tax agency that you are an independent consultant. Some tax tests are: Do you work at your own location on your own time? Do you use your own equipment? Do you pay your own business and administrative expenses? Do you have multiple clients?

- Charging hourly as a highly productive expert earns you less income. At an hourly rate the better and faster you work the less income you make. With a project-based fee the more productive you are the more you make. As an expert charging hourly market rates, you may make less income by being better!

If you are working for an hourly or daily rate it is best for you and the client to,

- Create a well-defined Statement of Work with the tasks you will do and deliverables you will produce

- Transition to project-based consulting rates as quickly as possible. The advantages of project-based fees are covered in 9 Consulting Fee Structures to Boost Your Income.

A Quick Way to Estimate Consulting Fees for New Consultants

Always know the hourly rate for the full-time equivalent employee of your consulting work. Once you know that, you can use the quick and dirty way for new independent consultants to calculate a range for your hourly rate.

The quick way to calculate the range for your consulting hourly rate is to lookup the rate for an employee with your experience and skill in the same field and geographic location. Then double or triple that employee’s salary earned per hour.

Low-End Consulting Hourly Rate = 2 X Equivalent Employee Hourly Rate

Realistic Consulting Hourly Rate = 3 X Equivalent Employee Hourly Rate

You can find an approximation of your Equivalent Employee hourly rate by going to,

When you multiply an employee salary (per hour) by two or three (2X or 3X) you roughly account for the extra costs and risks an employer pays beyond salary. However, as later calculations show, these estimates could be way off causing you to lose income by under bidding or lose clients by over bidding.

As an independent consultant you have to pay the costs it takes to keep a business running: general and administrative expenses, health insurance, education, and you take the RISK involved in any business.

In the US you must also pay your own self-employment tax in addition to income tax.

Also, you cannot work 100% of your time. You must reduce your 8 Hrs X 5 Days X 52 Weeks by the time you spend looking for new clients, administrative time, skills/education time, and vacation time.

WARNING:

A few of the online consulting fee calculators and guides assume you can work 2,080 hours per year. That means you work every possible hour, no vacation, no sick days, no marketing, no learning,… I doubt it!

I used to estimate that 30% of my time was spent looking for new clients – that is until I learned how to build the Marketing Machines I teach in Consulting Mastery Series(tm) courses.

Very importantly, you are a business, and in addition to paying for expenses you deserve a profit margin of at least 15% to 20%.

If you are going to use a gross estimate and go no further, then use an Equivalent Employee’s hourly salary and multiply by three, X 3.

A More Accurate Way to Calculate Your Hourly Consulting Rate

Here is how you can more accurately calculate your hourly consulting rate.

1. Finding Your Equivalent Employee Salary

Look on a job or salary board, such as Indeed, Payscale, Glassdoor, or Salary. Search for an equivalent employee or consultant doing your type of work. Be sure to filter for industry, field of work, experience, education, certifications, and location.

https://www.payscale.com/salary

https://www.glassdoor.com/Salaries/index.htm

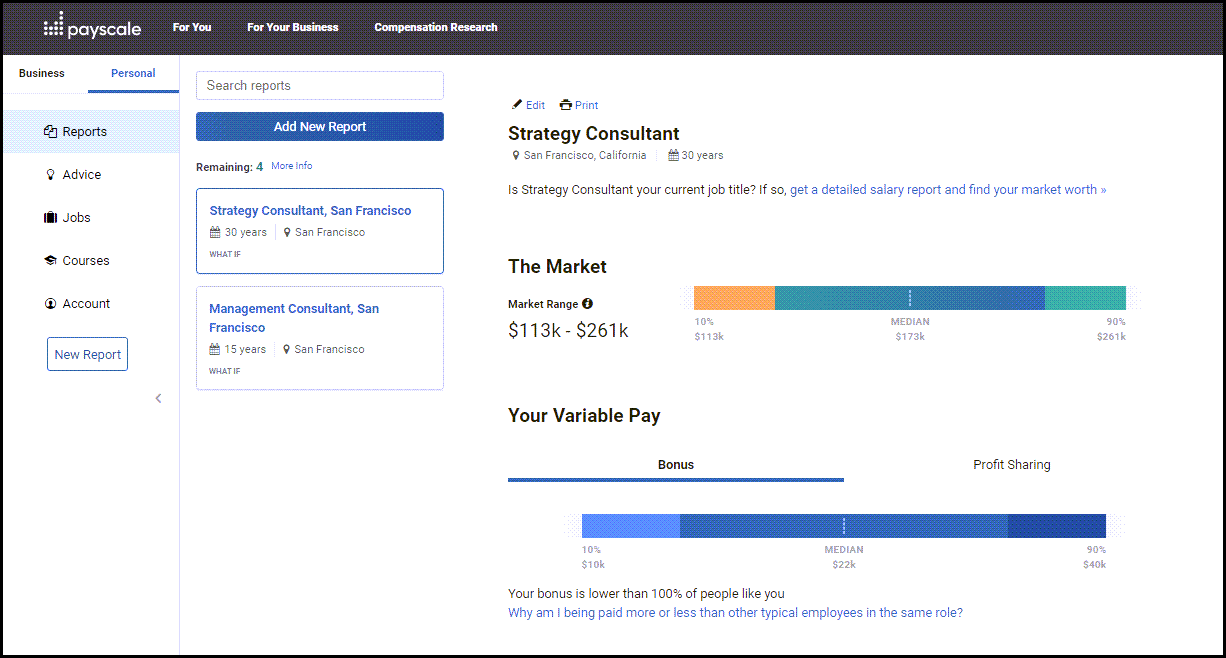

The following is a Payscale.com result for an experienced strategy consultant working as an employee in San Francisco, California, Bay Area. If your consulting is more operational you may need to look for an equivalent employee or executive salary rather than including the word "consultant" in the job description.

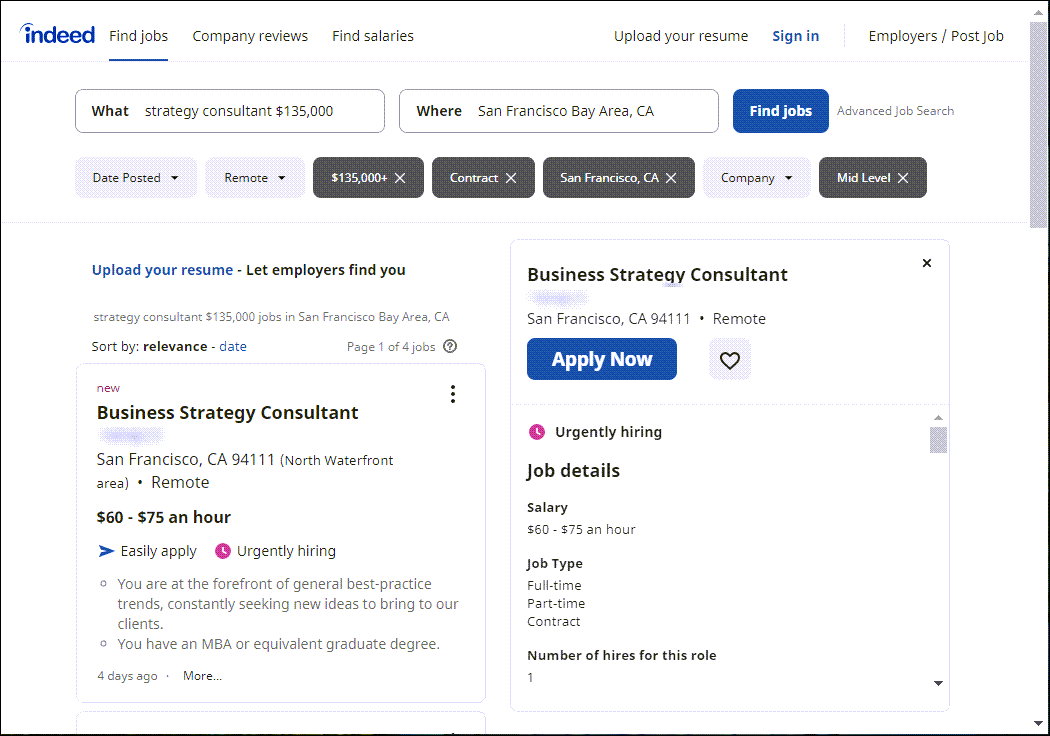

The following figure is for an Indeed.com result for a company looking for a mid-level strategy consultant as an employee in the San Francisco, California, Bay Area. If your consulting is more operational you may need to look for an equivalent employee or executive salary rather than including the word "consultant" in the job description.

These are salaries for an employee of a company. These are NOT billable rates to the client. You can calculate billable rates using the steps in this blog.

First, if you found an hourly salary, convert it to annual salary. Multiply the hourly salary by 2,080 hours/year. (52 Weeks * 5 Days/Week * 8 Hours/Day) This assumes two weeks of paid vacation.

For example, using the high salary for the business strategy consultant, $75/hr., then,

$75/Hr * 2,080 Hrs/Yr = $156,000 Annual Employee Salary Before Tax

Let’s round that to $150,000 Equivalent Employee Salary to make future sample calculations easier.

Remember, this is the Market Rate for an employee. You must adjust it for Billable Hours, Operational and Administrative Expenses, and Profit Margin.

As an independent consultant you cannot do 2,080 hours of client work per year or your mental health bills and divorce attorney bills will go through the roof.

You need to adjust for how many billable hours you can work. And you need to increase revenue to account for operating and administration costs and profit margin.

Let’s first adjust for Billable Hours.

2. Calculating Total Available Hours

Total available hours are all the possible hours available, billable and non-billable. Let’s assume you have stabilized your new consulting business and aren’t working the long hours sometimes needed the first year.

The calculation is 52 weeks minus 2 weeks of vacation. Working 5 days per week and 8-hour days.

That is 2,000 Total Available Work Hours per Year.

The 2,000 hours is less than the 2,080 hours from step 1 because it does not include two weeks paid vacation. (Give your brain a break and let that neuroplasticity kick-in to grow new connections.)

3. Calculating Billable Hours

As an independent consultant, you must work on and in your business in addition to client work. Those are hours when you are unavailable for client work.

Calculate billable hours by taking Total Available Hours and subtracting hours you are working on or in your own business.

The largest chunks of non-billable hours are,

Sick/Personal Days

Sick/Personal Days in US small businesses range from 5 to 10 days per year.

https://smallbusiness.chron.com/industry-standard-sick-days-73953.html

Assume: 5 days/year

Education Days

I assumed one to two conferences or education weeks per year to stay at the top of my expertise. With all the virtual conferences and online learning, you might need fewer days away, but you are still spending time away from work, non-billable hours.

Assume: 5 days/year

Administrative Time

You better not forget to do invoicing, accounting, external hard drive backup, tech maintenance, etc. If it gangs up on you something critical will go wrong at the worst time. Before I had a part-time secretary, I devoted a full Friday each week to administrative and marketing work.

Assume: 50 days/year

Promotion, Marketing, Sales

New consultants should assume they will spend 30% of their time promoting, marketing, and sales to gather new clients.

50 Weeks * 5 Days/Wk * 30% = 75 days/year

Assume: 75 days/year

Wow! That is a lot of time spent getting new clients. You can GREATLY INCREASE YOUR BILLABLE HOURS by creating Marketing Machines like the ones I teach in the Starting and Building a Thriving Consulting Business course.

Calculate Billable Hours

That adds up to 135 Non-Billable Days per year or 1,080 Non-Billable Hours per year.

Your Available Billable Hours are

2,000 Available – 1080 Non-Billable Hours = 920 Billable Hours/Yr

You only have 920 hours per year to make billable income!

Now you need to adjust for your costs of running a business.

4. Calculating Operating and Administration Expenses

Something new independent consultants often forget is that they are running a real business - keeping the lights on, updating computer hardware, paying fees, and buying insurance costs money. These are your Operating and Administrative expenses. While almost all of them are tax-deductible, they come out of your Gross Revenue and impact your income.

Estimated Costs

For your costs of doing business, you can use an estimate or be more detailed and itemized.

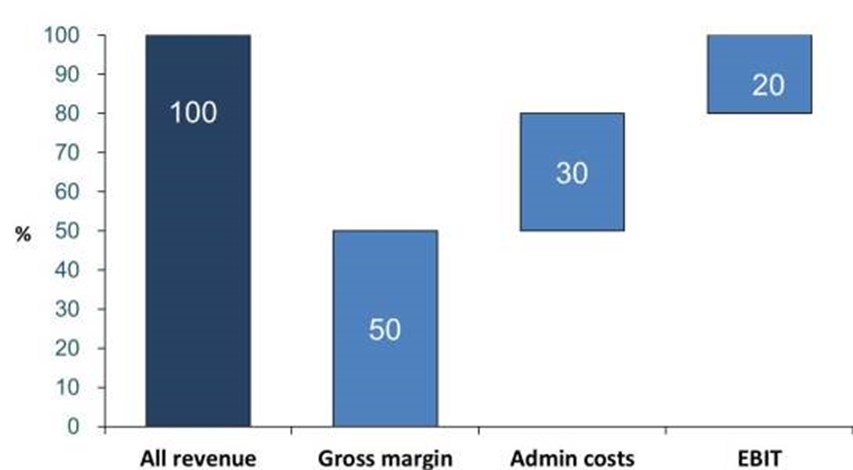

A quick, but approximate guess at operating and admin costs is that it is 30% of your Gross Revenue.

I’ve heard for years to use a 30% estimate for operating and administrative expenses. In researching this blog, I found that research on Metric.AI website also estimates 30%, as shown in a later step.

Itemized Costs

Having been an independent consultant for 30+ years I’ve found my itemized costs have been less than the 30% estimate. This is something I can control to increase my profit margin.

Through that time, I’ve run my consulting from a home office and from two different solo-offices of about 900 square ft. including a secretary's anteroom. I always budgeted for replacement computers and tech every three years. Expenses probably ran more toward 15% - 25% rather than 30%. With a home office and no clients visiting your home (no business liability insurance) you can significantly reduce costs.

If you want to be more accurate you can itemize operating and admin costs. Some of these are,

- Marketing and Advertising Costs (not your time)

- Computer Equipment

- Office Equipment

- Internet and Software as a Service (SaaS)*

- Education

- Memberships

- Professional Fees, Associations

- Insurance

(Auto, General Liability, Errors and Omissions, if needed) - Healthcare Insurance

Office Expenses and Supplies

Rent (talk to your CPA about the advantages/disadvantages of a home office as a tax deduction)

* Software as a Service (SaaS) includes subscription fees for software or internet services such as Microsoft Office, Google Drive, Canva, LinkedIn Navigator, etc.

If you are starting and have a home office without client visits (liability insurance), use 20% as an estimate of costs. If you’ve been in business for more than six months, check your accounting software and make an itemized list of expenses.

5. Estimating Gross Revenue

Now you need to adjust Equivalent Employee Income for the operating and admin costs that an employee does not have but that you as a self-employed consultant do have.

Estimating Gross Revenue

If you used a 30% estimate for operating and admin expenses, then estimate your Gross Revenue by adding 30% to Equivalent Employee Salary.

For example, if Equivalent Employee Salary was $150,000 then

$150,000 * 130% = $195,000

Itemized Gross Revenue

If you itemized operating and admin expenses, then add the expenses to Equivalent Employees Salary to get Estimated Gross Revenue.

For example, if Equivalent Employee Salary was $150,000 and your itemized total was $30,000 then $150,000 + $30,000 = $180,000

6. Adding Profit Margin

Many consultants running a small business act as though they are an employee to themselves. But you are smarter than that and realize you are running a business. You need a profit margin. All businesses need a profit margin.

Profit margin makes the difference between a business that grows and thrives and one that does not.

You Owe Yourself a Profit Margin

Consulting is a business with one of the highest profit margins. And, it has a low risk, assuming you have picked a good niche. (The consulting courses teach how to do this in Stage 1 Finding the Ideal Niche.)

Research shows that 20% is a very safe estimate for a thriving independent consulting business. Many boutique consulting firms in specialized niches have significantly higher profit margins.

“The typical profit margin for a professional services organization is in the range from 15% to 25%, while a particular project margin could be from 25% to 50%, and the profit margin for a particular consultant could be from 50% to 400%.”

https://www.metric.ai/metricopedia/profit_margin

Take your Gross Revenue and add a 20% profit margin.

Gross Revenue = Estimated Revenue * 120%

From step 6,

Estimated Gross Revenue

$195,000 * 120% = $234,000

Itemized Gross Revenue

$180,000 * 120% = $216,000

7. Calculating Your Billable Rate

You finally have your Gross Revenue and an adjustment for profit margin. And you calculated your Available Billable Hours. It’s time to get an answer – what is your billing rate?

Billing Rate = Gross Revenue / Billable Hours

From our previous examples,

Estimated Billing Rate

$234,000 / 920 Hrs = $254

Itemized Billing Rate

$216,000 / 920 Hrs = $235

You should round your hourly rates to the nearest $25 increment. These rates are $250 and $250. That put’s estimated and itemized at $250/Hr for an experienced business strategy consultant. (With a good brand, testimonials, and case studies.)

The Daily Consulting Rate is then

8 Hrs / Day * $250/Hr = $2,000 / Day

8. Adjusting for US Self-Employment Tax and Retirement

There are two things not included in the above calculations. They depend upon the country where you pay taxes and receive retirement compensation.

In the United States, self-employed people must pay a self-employment tax of 15.3%. This is in addition to income tax.

Most former corporate employees are shocked by this "new tax." When you are a corporate employee, most of this tax is paid by the employer. As a self-employed professional you must pay it yourself.

“The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).”

https://www.irs.gov/businesses/small-businesses-self-employed/self-employment-tax-social-security-and-medicare-taxes

Another “tax” to consider is taxing yourself for retirement.

As soon as possible you should begin saving for retirement. The percentages I hear most frequently are 10% to 15% invested each month using dollar cost averaging to buy balanced stock/bond mutual funds.

As a self-employed person in the United States, you will want to put your retirement investments in an IRA, SEP-IRA, or Roth IRA. If you have children and plan for college, you can stash funds in a 529 Plan and lower taxes. (These vary by state.) Check with your accountant for which retirement and 529 Plan are best for you. They can save you money.

9. Increasing Your Income and Independence

There are many ways to increase your income as an independent consultant while maintaining the same billable rate.

These techniques can give you more income and independence, allow you room to negotiate fees, and save more for retirement and investment.

The Starting and Building a Thriving Consulting Business course teaches these techniques in areas such as,

- Decreasing your operating and administrative expenses

- Decreasing your time (cost) in converting new clients

- Increasing client engagements with expanded delivery

- Increasing value delivered

- Developing global micro-niches you can dominate

- Automating promotion and marketing with a Marketing Machine

- Creating multiple streams (almost passive) of consulting income

Learn More in the eBook on this Topic:

Calculating and Setting Consulting Fees

Learn More in Blogs on this Topic:

Compare Your Consulting Fees to 21 Types of Consultants

Calculating and Setting Project-Based Consulting Fees